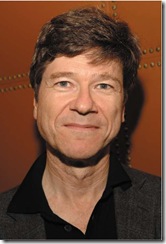

Michael Lewis (from "Liar’s Poker") wrote a piece in Portfolio Magazine that is a must reading (this earlier piece is also very good). It is at once nauseating, chilling, and fascinating to see how our financial system is a house of cards.

A couple years ago I got into a passionate debate with friends from the financial sector about the growing disintermediation between actual products we make in the "real" economy and the derivative products that get packaged and re-packaged and sold – always generating a fee for the financial firms that hawk them – without really creating value.

Michael Lewis explains better than anyone how this came about in the 80′s and how it came about with the current credit crisis.

The saddest thing is that, while there will be some short fixes and a lot of chest-thumping in Congress, by the media, and in the executive corridors, the system is so sick and so rigged by those that benefit from it, that it is unlikely to be structurally fixed.

As Lewis concludes in his piece, it would require that Wall Street firms go back to operating as private partnerships with skin on the game rather than become publicly traded firms where management can pass on long-term risks to shareholders, benefiting from short-term profits even if they are risking the fate of their institutions. Or it would require enough regulation that really tracks and connects compensation to long-term value creation.

Yet greed and ingenuity are potent combinations. And the "smart" guys will always find a way to game the system – with your money.

Even as we witness calamitous losses on the market, many insiders are doing quite well for themselves. They find the way. They are survivors. Several of my friends are in this industry. They are not bad people. They are just playing by the rules of the system, which banks on our own greed as investors to sustain and legitimate itself.

It is hard not to be tempted to participate in the market once it has been so depressed that it should have nowhere to go but up. And yet Lewis points out that someone who would have invested in the 80s in the predecessor to Citigroup would have lost more than half the value of the investment – rather accrue growth over a 22 year period!

Buyer beware.

And for the young people out there thinking what to do with their careers – many of whom Lewis laments having misread his book as an alluring tale for an exciting career – find something you can truly CREATE. There are sooo many opportunities to make this a better world through concrete businesses that truly improve life and society. There are so many opportunities to make money and do something truly good. To build something that adds value. Find one that is real.

[Read more →]