Can you blame "speculators"?

I was initially persuaded by media and pundit assertions that what is behind this meteoric rise in raw materials is at least connected to "speculation" – ie, hedge funds plowing in billions into commodity future contracts and other financial investments that make the goods artificially rise in cost.

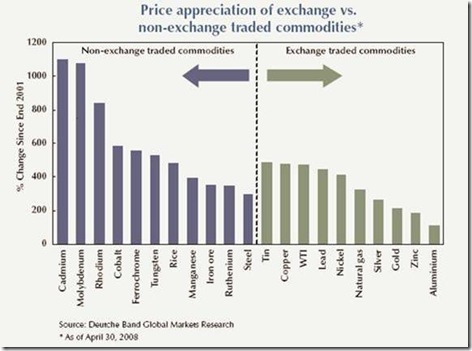

But look at the Deutsche Bank chart (which my law school buddy Stanley Haar shared with me) below.

Non-Exchange traded commodities have risen more than those traded on exchanges. Unless hedge funds are also buying the physical goods in all these sectors, the more likely culprits are sheer global over-consumption and over-consumerism. For years the mantra was that we should only hope the rest of the world will have a standard of living that is closer to the Western world’s. Now that India and China are more than catching up, we are learning how this taxes our planet.

A better plan would be for all of us to learn to live just a little bit more modestly and less wastefully.

related posts

-

Are speculators to blame for sky-rocketing energy and food prices?

According to my commodities futures trading genius friend Stanley Haar, this is a silly scapegoat because: True manipulation involves buying both futures contracts and hoarding the physical commodity, as attempted by the Hunt Brothers in the silver market years ago. I don’t believe this is happening now in the oil market or any other market. [...]

comments

[...] know if speculators are indeed behind the roller coaster ride of commodity pricing. And prior posts in this blog have pointed to arguments against blaming them. I just found it entertaining [...]

post a new comment